Trusted by 120,000 teams worldwide

Tailored solutions for finance professionals

Ensure every client interaction is personalized and compliant with a comprehensive CRM made for financial services.

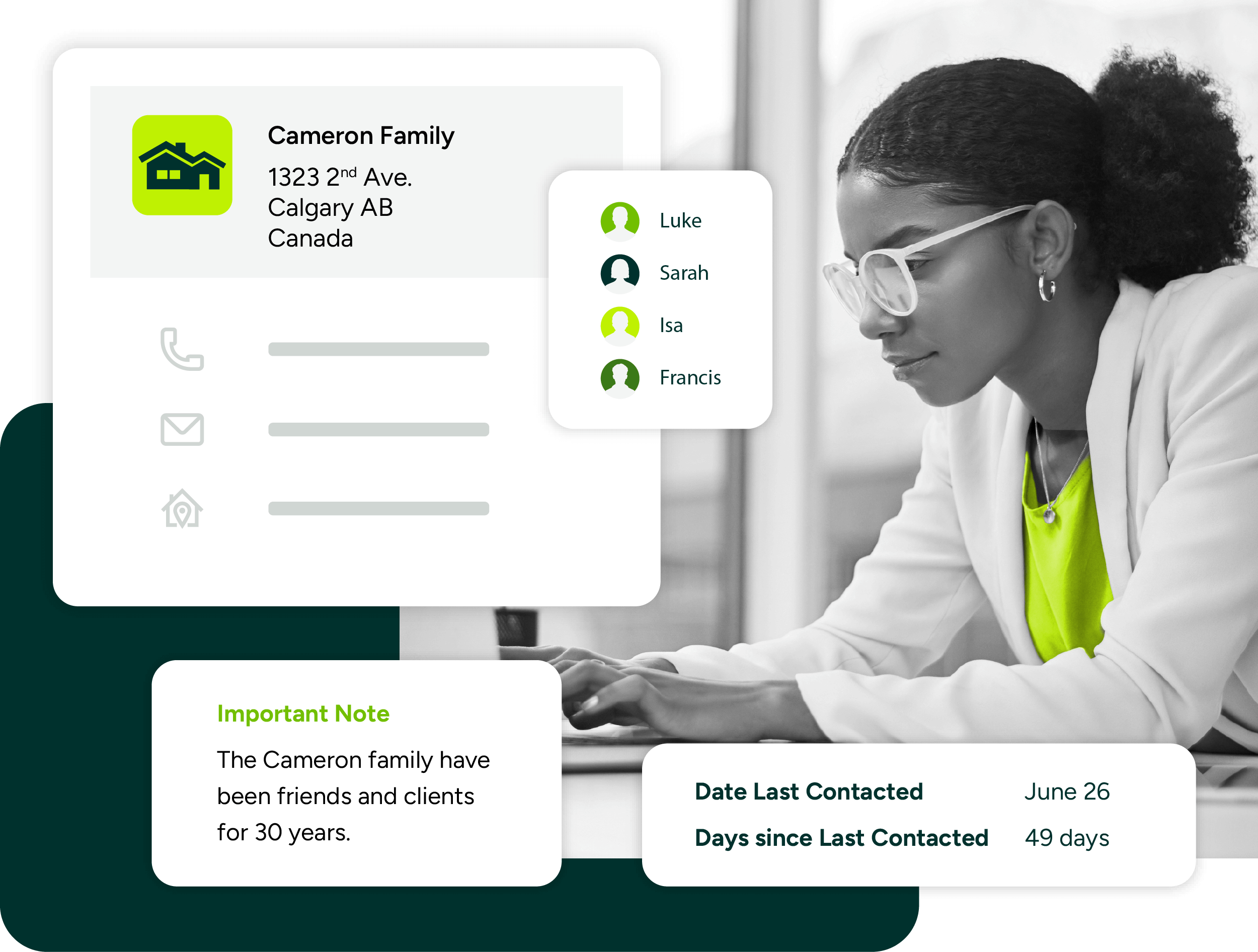

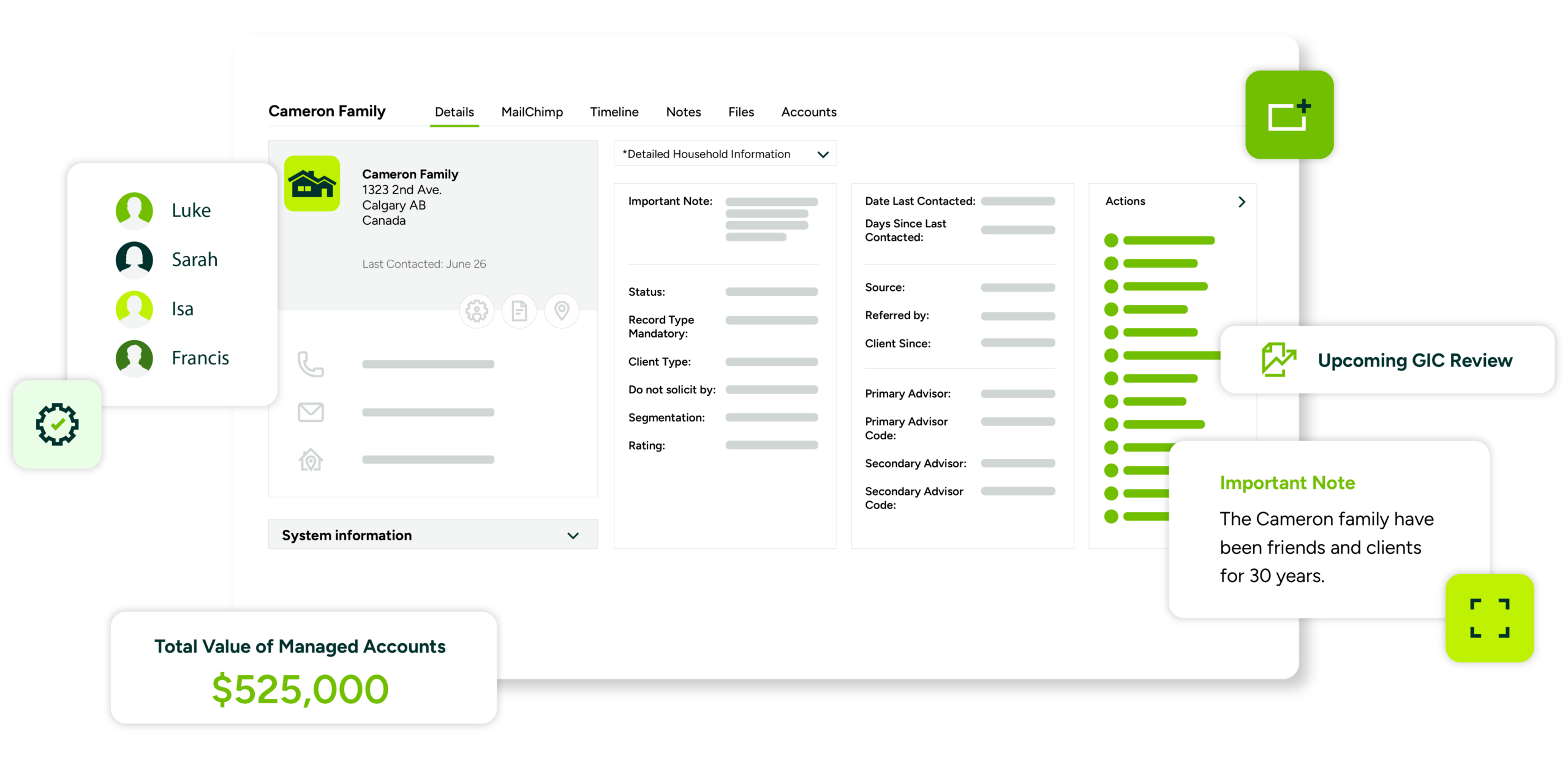

Client relationship tracking

Integration with financial planning tools

Task management and automation

Customizable dashboards and reports

Transform client engagement with smart CRM tools

Maximizer connects your data in one place so you can build stronger client relationships and deliver tailored advice.

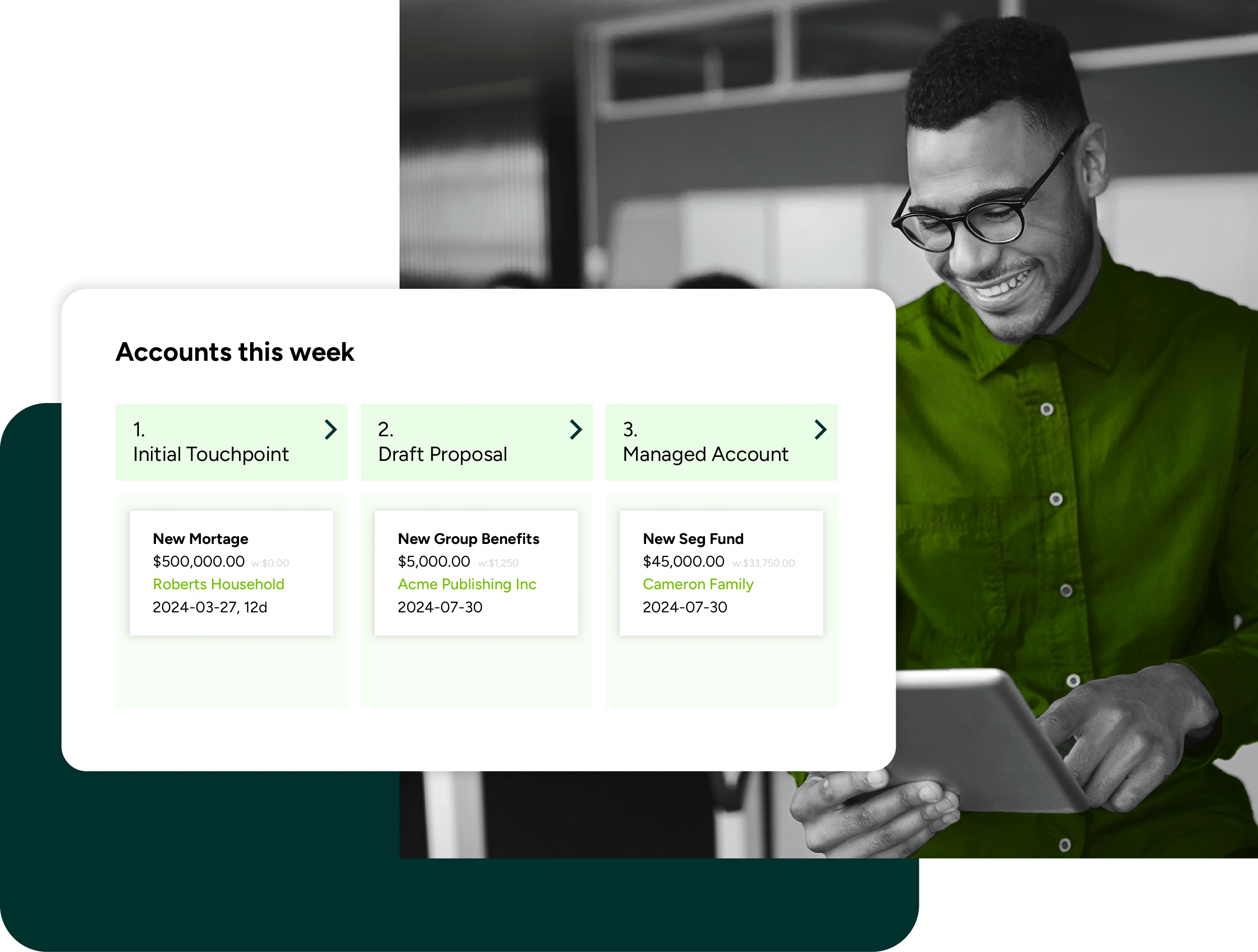

Personalized client journeys

Track life events and milestones to offer timely recommendations.

Automate follow-ups based on client interactions and preferences.

Provide proactive service by anticipating financial needs before they arise.

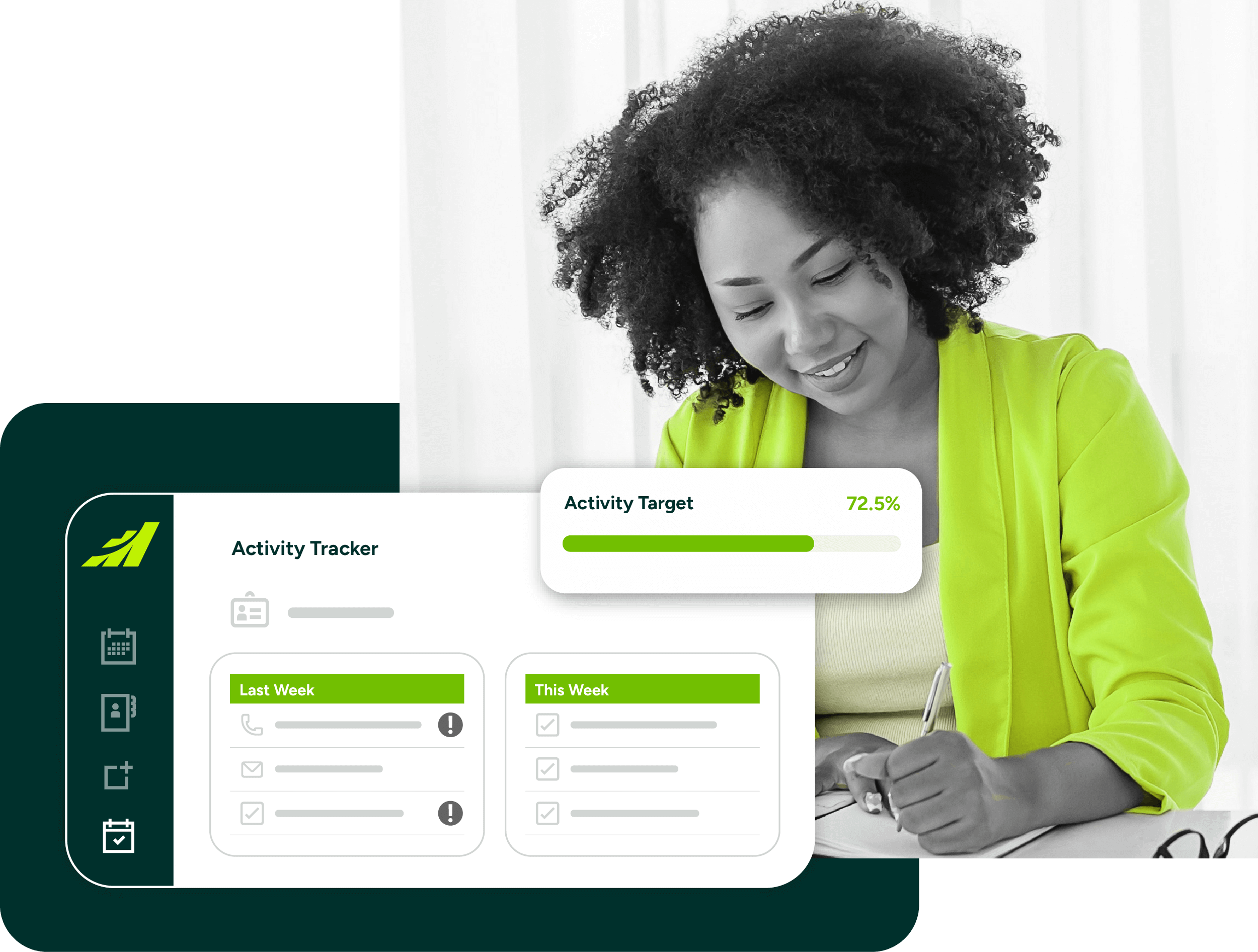

Real-time performance tracking

Monitor revenue trends and financial product performance in dashboards.

Identify opportunities for selling tailored financial solutions.

Set up alerts for key performance metrics to act proactively.

Simplified compliance and risk management

Generate compliance reports with built-in audit tracking.

Ensure data integrity with role-based access and encryption measures.

Reduce regulatory risks with automated documentation and reporting tools.

#1 CRM for financial services

Financial advisors rank Maximizer as the #1 Financial Services CRM on G2, the leading software review site.

Why financial professionals prefer Maximizer

Future-proof your financial services business

Adapt to market changes

Automate compliance updates to ensure adherence to industry standards.

Built in Canada

Regulatory compliance simplified

Maintain accurate records and generate detailed compliance reports.

Data security and privacy

Implement role-based access control to safeguard sensitive data.

Configure your CRM to fit your business needs

Quick and easy onboarding

Get up and running with guided setup and access to training resources.

Companies choose to partner with Maximizer

Learn why people love Maximizer

Cross Selling Opportunities in Insurance with CRM: Your Guide to Growth in 2025

Summary of cross-selling opportunities in insurance with CRM In 2025, insurance professionals are turning to CRM platforms to unlock powerful cross-selling opportunities that grow revenue, improve...

What the Best Financial Professionals Do Daily

Success in financial services isn’t just about assets under management (AUM), annual bonuses, or the number of policies sold. It's about what you do daily. In this business, momentum is built in the...

Lead Management System for Insurance: Your Guide to Boosting Sales in 2025

Lead management system for insurance: quick overview A lead management system (LMS) helps insurance agents capture, organize, and convert leads more efficiently. In 2025, tools like Maximizer will...

Try Maximizer Today

Experience a CRM built for financial advisors. Access accurate data, build client relationships, and grow your business with a CRM with industry knowledge.

Frequently asked questions

1. What is the best CRM for financial services?

2. How does a CRM benefit financial advisors?

3. Is Maximizer CRM secure for financial data?

4. Can Maximizer integrate with financial planning software?

5. How can I get started with Maximizer CRM?

Why financial services professionals need a CRM

In the financial services industry, maintaining strong client relationships is key to long-term success. Whether you’re managing investments, insurance policies, or client portfolios, having a reliable financial services CRM ensures that every client interaction is personalized, compliant, and efficient.

CRM for the financial services industry helps firms:

- Enhance client communication and relationship tracking.

- Automate administrative tasks, allowing advisors to focus on clients.

- Ensure compliance with industry regulations.

- Integrate with financial planning tools.

Key features of Maximizer’s financial services CRM

1. Client Relationship Tracking

Manage and track client interactions, investment preferences, and financial goals in one secure platform.

2. Automated Workflows and Task Management

Automate routine processes such as follow-ups, reminders, and approvals to improve efficiency and reduce manual workload.

3. Secure Document Storage and Compliance Tools

Stay audit-ready with secure, encrypted document storage, ensuring compliance with industry regulations.

4. Integration with Financial Planning Tools

Connect with financial modeling and wealth management software for real-time data insights.

5. Customizable Dashboards and Reporting

Get real-time reports and analytics tailored to your firm’s key performance indicators.

How Maximizer enhances client engagement for financial services

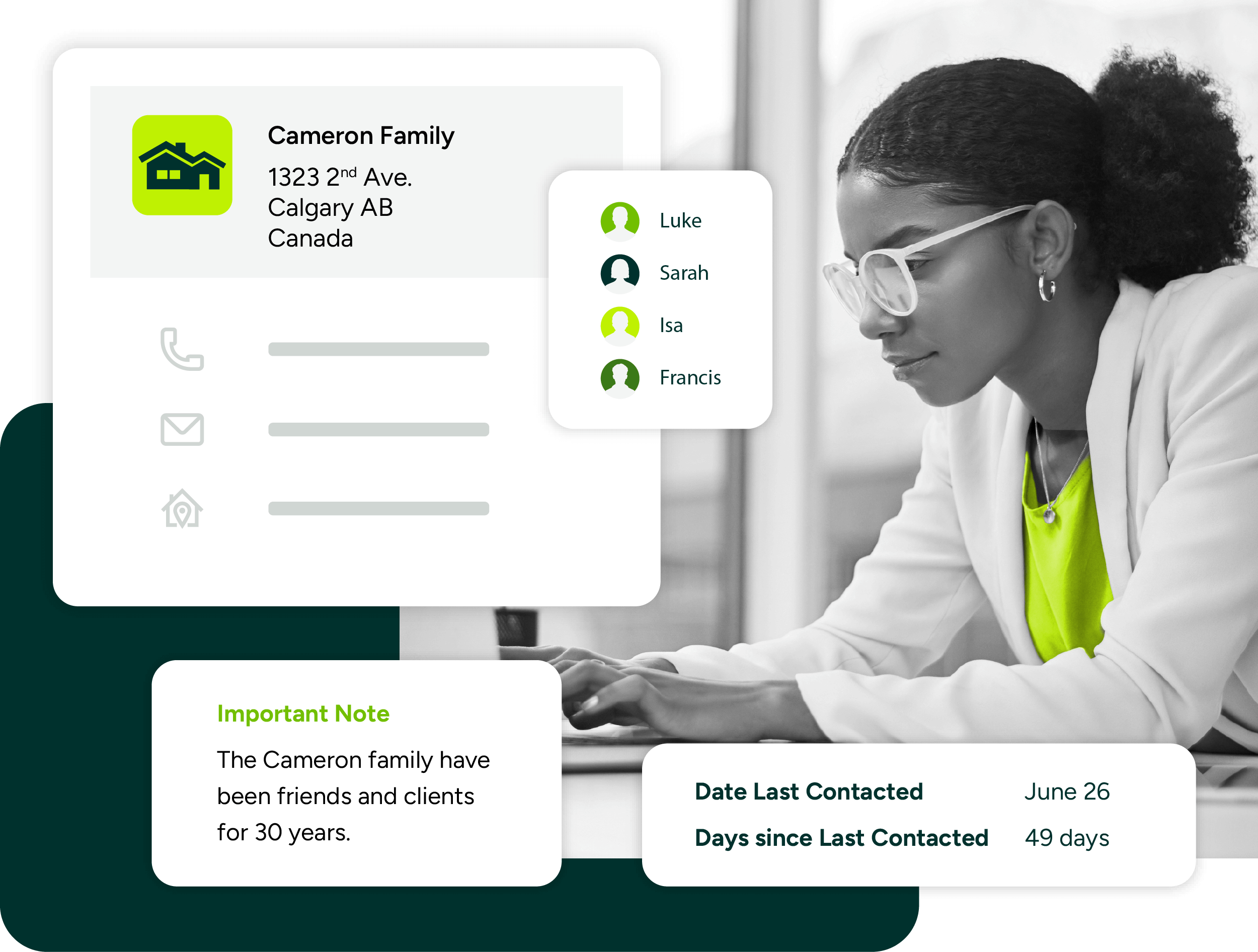

Personalized Client Communication

Deliver customized financial advice by tracking client needs, history, and future goals. Use segmentation tools to personalize outreach and financial planning strategies.

Appointment & Meeting Scheduling

Coordinate meetings and financial reviews with built-in calendar integrations. Automate appointment reminders and confirmations to keep clients engaged.

Segmentation & Targeted Outreach

Segment clients based on financial goals, investment preferences, or risk profiles to provide tailored financial strategies. Leverage data-driven insights to nurture client relationships and identify cross-selling opportunities.

Benefits of using Maximizer for financial services

Increased Productivity & Efficiency

Automate workflows and access client data quickly to spend more time building relationships. Reduce time spent on administrative tasks and focus on revenue-generating activities.

Improved Client Satisfaction & Retention

Personalized service and proactive client engagement increase trust and long-term loyalty. Build a solid client base with structured communication and easy onboarding.

Enhanced Data Security & Compliance

Ensure secure storage of financial records and maintain compliance with industry regulations. Keep data protected with role-based permissions and encrypted communication logs.

Scalable Solution for Growing Firms

Whether you’re a boutique financial advisor or a large investment firm, our CRM software for financial services scales with your business. Adapt workflows, add new users, and integrate additional tools as your firm grows.

How to implement Maximizer in your financial services firm

Step 1: Assess Your Business Needs

Identify your firm’s pain points and evaluate how a financial services CRM can address them. Consider factors like compliance requirements, reporting needs, and client engagement strategies.

Step 2: Customize for Your Workflow

Leverage customizable features to align the CRM with your firm’s specific processes and regulatory requirements. Create custom fields and automation rules that fit your advisory model.

Step 3: Train Your Team

Ensure smooth adoption by providing training on CRM best practices and key functionalities. Use role-specific training modules to ensure every team member maximizes CRM capabilities.

Step 4: Monitor & Optimize Usage

Regularly review CRM analytics to optimize workflows and enhance client engagement. Adjust processes as needed to maintain peak efficiency and compliance.

Explore CRM solutions for every financial sector

CRM for Insurance

Enhance policy tracking, claims management, and client retention for insurance agencies. Maintain policyholder details, renewal reminders, and claims history in a centralized system.

CRM for Wealth Management

Optimize investment strategies, manage client portfolios, and ensure compliance with regulatory standards. Track assets under management (AUM) and analyze investment performance.

CRM for Asset Management

Track assets, monitor performance, and facilitate communication with investors. Generate reports on asset allocations and real-time valuations for better decision-making.

CRM for Investment Management

Enable investment advisors to offer tailored strategies with comprehensive client insights. Access detailed financial data, risk assessments, and performance tracking tools.

CRM for Investment Banking

Support deal tracking, relationship management, and regulatory compliance. Automate due diligence processes and manage complex financial transactions.

CRM for Banking

Improve customer relationships, loan processing, and risk management. Integrate with loan origination systems, underwriting platforms, and compliance tracking tools.

CRM for Fintech

Support digital transformation with automation, AI-driven insights, and integration with financial platforms. Enhance fintech product adoption with customer behavior analytics.

CRM for Lending

Simplify loan processing, automate approvals, and enhance customer service in lending institutions. Track loan applications, repayment schedules, and interest calculations.

Why choose Maximizer CRM for financial services?

Trusted by Industry Leaders

Maximizer built the Financial Services Edition CRM with clients in the industry to build a reliable solution tailored to their needs.

Easy-to-Use Interface

Our intuitive CRM software ensures fast adoption, reducing learning curves and maximizing efficiency.

Dedicated Customer Support

Gain access to expert support and tailored solutions to help your firm succeed.